Taking a long-term loan with a poor credit situation sounds challenging. But it is not impossible because of the new-age lending process. Approval decisions are not solely based on credit score. Prove your repayment ability and get approved for the long-term loans for bad credit. But some other factors also matter when you apply for the loans.

A strategy to apply safely is vital

If you follow certain ways to apply safely and know about the relevant application formalities, approval is easier. Here is a complete guide for you to know how to proceed in an organised way to get funds smoothly.

What is a long-term bad credit loan?

A long-term bad credit loan is a specialized financial solution designed for people with a poor credit score. Due to longer tenure, you repay funds typically in 5, 7 or 10 years. It can be secured or unsecured as per your financial circumstances.

- Features of a long-term loan for bad credit –

Higher rate of interest

Long tenure from 5 to 10 years

Smaller loan amount as compared to standard loans for good credit people

Credit-friendly lending policies

Higher approval rate in case of direct lenders if you borrow collateral-free

Approval as per current repayment ability

Types of long-term loans for bad credit

The loans for bad credit are of different types. All the loan products that can be obtained irrespective of credit score status for a longer period are included as types.

- Secured personal loans – These loans include collateral. You pledge an asset like a vehicle or property. Due to security, you can borrow a large amount at a lower rate of interest. In case of default, the lender can repossess your property.

- Unsecured personal loans – These are not secured against collateral, hence have a higher interest rate compared to secured ones. The typical tenure is between 1 and 5 years. In case of a strong repayment ability, tenure can be up to 7 years. However, with bad credit, it is not very common.

- Credit union loans – These are community-based loans where credit unions offer loans to people with poor credit. But considering the bad credit situation, they may not be flexible on approving a large amount.

- Home equity loans – With time, your home value improves and can be encashed in the form of a loan. These are usually approved easily as you borrow against your property. But repay on time, as these loans are secured against your home. Not paying on time puts your property at risk.

Why do long-term bad credit loans have higher interest rates?

Due to some specific reasons, the loans have a higher rate of interest. If you know about them, you can work on factors to get an affordable deal.

- Due to your bad credit score, lenders take a higher risk.

- As per lending ethics, lenders cannot offer a lower rate for poor credit loans.

- In the case of unsecured loans, default can make the lender bear a big risk. Hence, a higher rate is charged.

Tips for sustainable borrowing

Borrowing with a less-than-perfect credit score demands attention to detail. You cannot take the risk of losing a chance to prove your repayment ability. That is the primary factor to get approval.

- Assess your financial needs - Be sure about your financial needs and decide the loan amount you actually need. Apply for the loan only if the need is real and unavoidable.

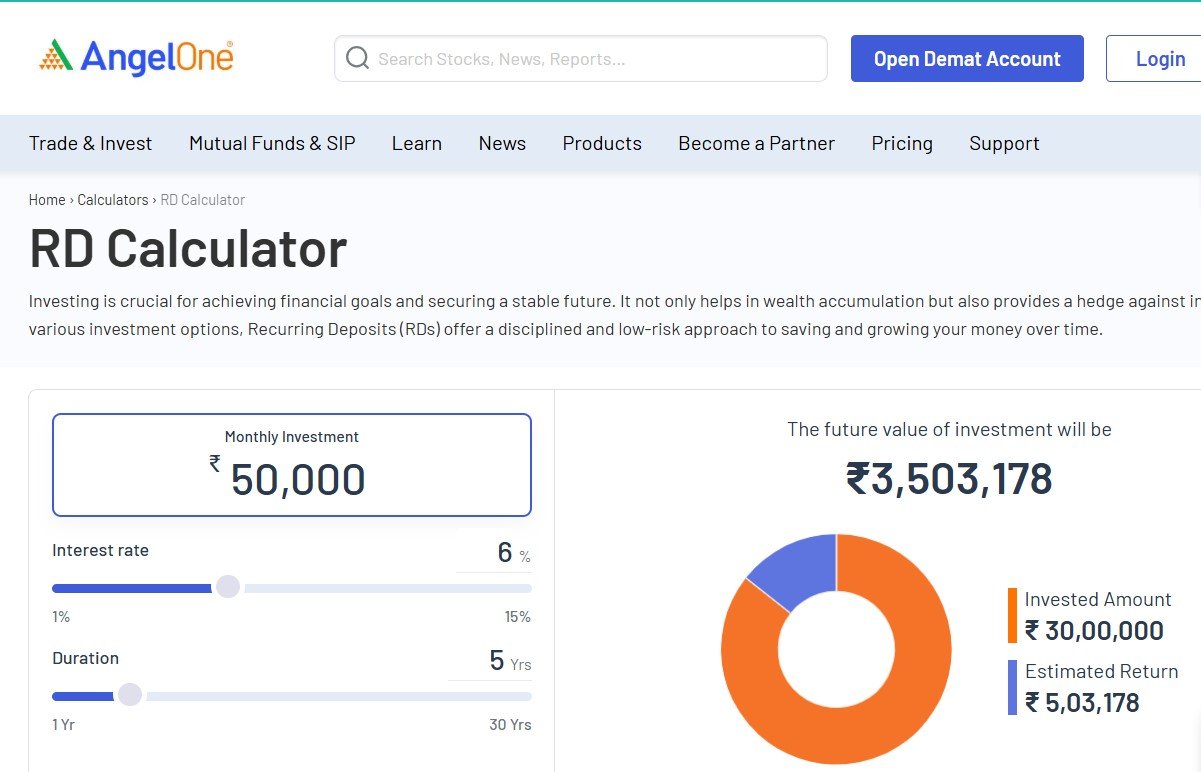

- Know your repayment ability – Use the loan calculator to know your repayment ability after you decide on the loan amount. Mention the required amount and some basic income details, and the calculator will give an approximate interest rate and monthly instalment.

- Improve credit score (if possible) - If you can, work on this factor. Try to improve your credit score before applying for the loan. This boosts your ability to get a larger amount at a lower rate over a desired tenure. Pay other debts and bills on time and improve your credit score.

- Compare lenders and their offers – Taking a loan without comparison is foolish. Always compare multiple lenders and their offers. Apply for a soft check process or pre-qualify to know which one gives you the best deal.

- Use collateral only if you can repay on time – Pledging an asset as collateral is always risky. If you default, the lender can claim your asset and sell it to recover its loss. Therefore, think twice before you choose the secured loan option.

- Be careful while choosing a longer term – Longer tenure means smaller monthly instalments but higher total interest. It means you will end up paying more on the loan amount.

- Keep an emergency fund for repayments – In case of an emergency, you may find it difficult to pay the instalments. Hence, create an emergency fund to keep repaying the loans hassle-free. You can avoid missed or delayed payments that can adversely affect your credit score.

Ways to rebuild credit after getting a loan

Your long-term bad credit loan is an opportunity to boost your credit score and bring your financial life back on track.

- Make timely payments – Pay the instalments on time. With every timely payment, your credit score boosts.

- Keep a low credit utilization ratio – Keep your ratio up to 30% as beyond that, repayment gets difficult. Also, it affects your credit score negatively.

- Monitor credit reports regularly – Check your credit report to check if your lender is updating the credit reference agencies about your timely payments.

Common mistakes you should avoid

Many applicants make several mistakes while applying, which affects their approval chances. Read them here and avoid them if you are planning to apply.

Mistakes | How do they affect? |

Borrowing without a repayment budget | You may miss or delay repayments in case of other financial urgencies. |

Ignoring fees and penalties | You may end up paying more and find the loan cost is high |

Defaulting or missing instalments | It immediately drops your credit score affecting future loan chances. |

Choosing the lowest amount for monthly payments | Debt stays for a long time and you pay higher interest rate in totality. |

Using the loan money for discretionary expenses | You fail to deal your financial needs and damage financial stability. |

What are the alternatives to long-term loans?

Before applying for the long-term loans for people with poor credit, you can consider the following alternatives, too.

- Debt consolidation – Why take a new loan? Consolidate existing debts, pay one instalment at a fixed rate in place of many repayments. Now you can save a lot of money to pay for expenses and can avoid taking a new loan.

- Credit counselling – Credit or debit advice is available. You can get paid as well as free service. It will help you manage the debts efficiently through a bargain with the current creditors on lower rates and flexible repayments.

- Borrow from friends and family – An option you can choose if you have people around you who can help during bad times. But be cautious, as money matters sometimes affect relationships negatively.

Conclusion – Responsible borrowing is all about smart strategy

With the information above, you can get direct lender bad credit loans with guaranteed approval. With strong repayment ability, you can avoid using collateral. Hence, work more on your personal credit purchase power before applying. This will make borrowing predictable for you and lending less risky for the lender.

Tags : Bad Credit