How to Print Your W-2 and W-3 Forms in QuickBooks – Step-by-Step Guide

By QuickBook SupportNet 13-10-2025 122

Printing your W-2 and W-3 forms in QuickBooks is a crucial task for accurate year-end payroll reporting. If you’re handling QuickBooks payroll, knowing how to print your W-2 and W-3 forms in QuickBooks ensures compliance with IRS requirements and smooth filing. Whether you’re a small business owner or an accountant managing multiple employees, this guide will walk you through every step. For any assistance, you can also call +1(866)500-0076 for expert support.

QuickBooks simplifies payroll management, including generating and printing tax forms like W-2 and W-3. W-2 forms report individual employee wages and taxes withheld, while W-3 forms summarize all W-2 data submitted to the IRS. Properly printing these forms saves time, avoids penalties, and ensures accurate reporting.

Easily print your W-2 and W-3 forms in QuickBooks for accurate year-end payroll reporting. Step-by-step instructions and tips included.

Prepare QuickBooks for W-2 and W-3 Printing

Before you print, make sure your QuickBooks payroll data is complete:

Verify employee names, Social Security numbers, and addresses.

Confirm payroll totals are accurate for the year.

Update company information, including EIN and address.

QuickBooks also allows you to preview forms before printing, which helps identify mistakes and correct them early.

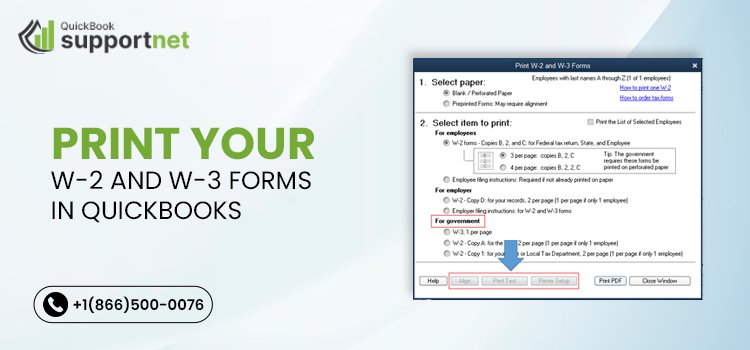

Printing W-2 Forms in QuickBooks

Open QuickBooks Desktop or QuickBooks Online.

Go to Employees > Payroll Tax Forms & W-2s.

Select Annual Form W-2/W-3 – Wage and Tax Statement.

Choose the tax year and employees to include.

Click Preview to review the form for errors.

Click Print and select the printer settings.

Ensure you use pre-printed W-2 forms if required. QuickBooks also allows printing on blank paper compatible with IRS formatting.

Printing W-3 Forms in QuickBooks

Navigate to Employees > Payroll Tax Forms & W-2s.

Select Annual Form W-3 – Transmittal of Wage and Tax Statements.

Verify that all employee W-2 forms are complete.

Click Print and confirm printer settings.

Remember, the W-3 form acts as a summary of all W-2 forms submitted to the IRS, so accuracy is critical.

Filing Electronically or by Mail

QuickBooks also supports electronic filing for W-2 and W-3 forms. E-filing can save time, reduce errors, and ensure faster processing by the IRS. If you prefer to mail, double-check that forms are printed on official W-2 and W-3 paper and include all employees.

Tips for Accurate W-2 and W-3 Printing in QuickBooks

Always double-check employee details before printing.

Preview forms to catch errors early.

Keep digital and physical copies for records.

Update QuickBooks payroll settings to avoid discrepancies.

Use QuickBooks payroll reports for reconciliation.

By following these tips, businesses can avoid costly errors and simplify the year-end filing process.

Conclusion

Printing your W-2 and W-3 forms in QuickBooks doesn’t have to be stressful. With proper preparation, verification, and careful printing, you can ensure accurate payroll reporting for your employees and compliance with IRS requirements. Remember, QuickBooks streamlines the entire process, from employee data management to year-end filing. For additional guidance or troubleshooting, call +1(866)500-0076 to get expert assistance.

FAQs

Q1: Can I print W-2 forms for all employees at once in QuickBooks?

Yes, QuickBooks allows batch printing for all employees’ W-2 forms, saving time and reducing errors.

Q2: Is it necessary to print W-3 forms if I e-file W-2s?

No, W-3 forms are only required for physical filing. E-filing automatically generates the W-3 electronically.

Q3: Can I correct mistakes on W-2 forms in QuickBooks?

Yes, QuickBooks provides a way to create corrected W-2 forms (W-2c) if any errors are detected.

Q4: What should I do if my QuickBooks W-2 doesn’t match IRS records?

Double-check payroll entries and employee information. If needed, generate W-2c forms for corrections and re-submit.

Q5: Can QuickBooks print W-2 forms on blank paper?

Yes, QuickBooks supports printing on blank paper that meets IRS formatting guidelines.