The global financial landscape is changing rapidly, and digital assets are leading the way. What once seemed like a speculative experiment has now evolved into a recognized part of modern finance. Investors of all levels are exploring opportunities in digital markets, from everyday enthusiasts to large institutions. As these shifts occur, conversations around safety, strategy, and the future of money are becoming more important than ever.

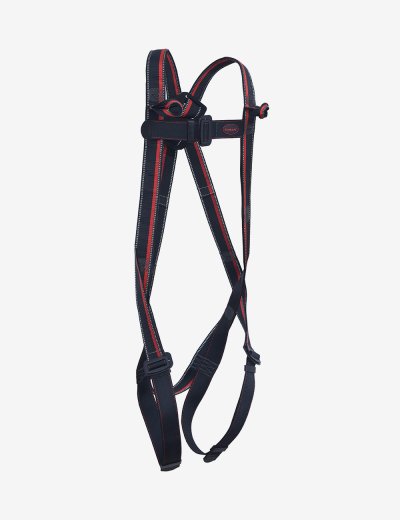

One of the key discussions focuses on how investors protect their assets in a space that never sleeps. Methods such as cold wallet crypto storage highlight the importance of self-custody, privacy, and independence. These approaches are not just about security. They also represent confidence, control, and resilience in a fast-moving financial world.

The Rise of Digital Assets

Digital assets have grown far beyond early expectations. They now power decentralized applications, global transfers, and innovative financial services that operate without traditional intermediaries. This rise has attracted attention across the world, with adoption rates increasing and markets expanding.

For investors, the opportunity is vast, but so is the learning curve. Unlike conventional investments, digital assets require a deeper understanding of technology, security measures, and the risks tied to volatility. Those who take the time to build knowledge are often better positioned to make informed decisions.

Why Security Comes First

Every investment journey begins with the question of safety. Digital assets exist in a space where mistakes can be costly, and lost access often means permanent loss. Hacks, phishing attempts, and platform failures remind investors that managing risk is a top priority.

Security solutions allow individuals to take ownership of their investments. They provide a safeguard against the unpredictable nature of online systems. By focusing on protection first, investors create a strong foundation that supports all future strategies.

Balancing Risk and Reward

The digital finance market offers incredible potential, but it also carries risks. Sudden price movements can create significant gains or steep losses within hours. New projects emerge constantly, offering promises of innovation, yet not all are built to last.

Smart investors recognize the importance of balance. Instead of chasing every new opportunity, they carefully assess fundamentals such as technology, transparency, and long-term value. This mindset helps filter out speculation and prioritize projects that stand a chance of enduring market shifts.

Diversification in a Digital Portfolio

Diversification has always been a central principle of investing, and it applies equally to the digital economy. Holding a variety of assets helps cushion the impact of volatility and ensures that one setback does not define the entire portfolio.

Investors often combine established assets with smaller experimental positions, creating a blend that offers both security and growth potential. This approach enables them to benefit from new trends while still maintaining a safety net.

Market Trends to Watch

Several forces are shaping the future of digital finance. Regulation is one of the most impactful, with governments worldwide working to create clearer frameworks. While some investors worry about restrictions, regulation often leads to broader adoption and legitimacy.

Another trend is the development of scalable and energy-efficient technologies. Faster transaction speeds and lower costs are making digital platforms more accessible. As improvements continue, more people and businesses are expected to enter the market, driving further innovation and growth.

The Role of Education

Knowledge is perhaps the most valuable tool an investor can have. Understanding the basics of blockchain, market cycles, and asset management reduces uncertainty and strengthens decision-making. Education helps investors avoid common mistakes while equipping them to evaluate opportunities with confidence.

Communities, online resources, and educational programs provide pathways for learning. In a fast-changing environment, staying informed is not just beneficial. It is essential for long-term success.

Thinking Long Term

While digital finance often attracts attention for its short-term gains, the most successful strategies tend to focus on the long term. Patience and perspective help investors ride out volatility and avoid emotional decision-making.

This approach is about seeing beyond the daily headlines. The financial system is evolving, and digital assets are becoming part of that transformation. Investors who position themselves with patience, discipline, and resilience are more likely to benefit from the larger shift that is underway.

Preparing for the Future

The future of finance will be more digital, more global, and more connected than ever before. Investors who thrive will be those who build secure foundations, remain adaptable, and embrace lifelong learning.

By combining strong security practices, diversified strategies, and a commitment to knowledge, investors are not only protecting their wealth but also preparing to take part in shaping a financial system that is still being built. The opportunities ahead are vast, and the best way to approach them is with both caution and curiosity.

Tags : Financial Security