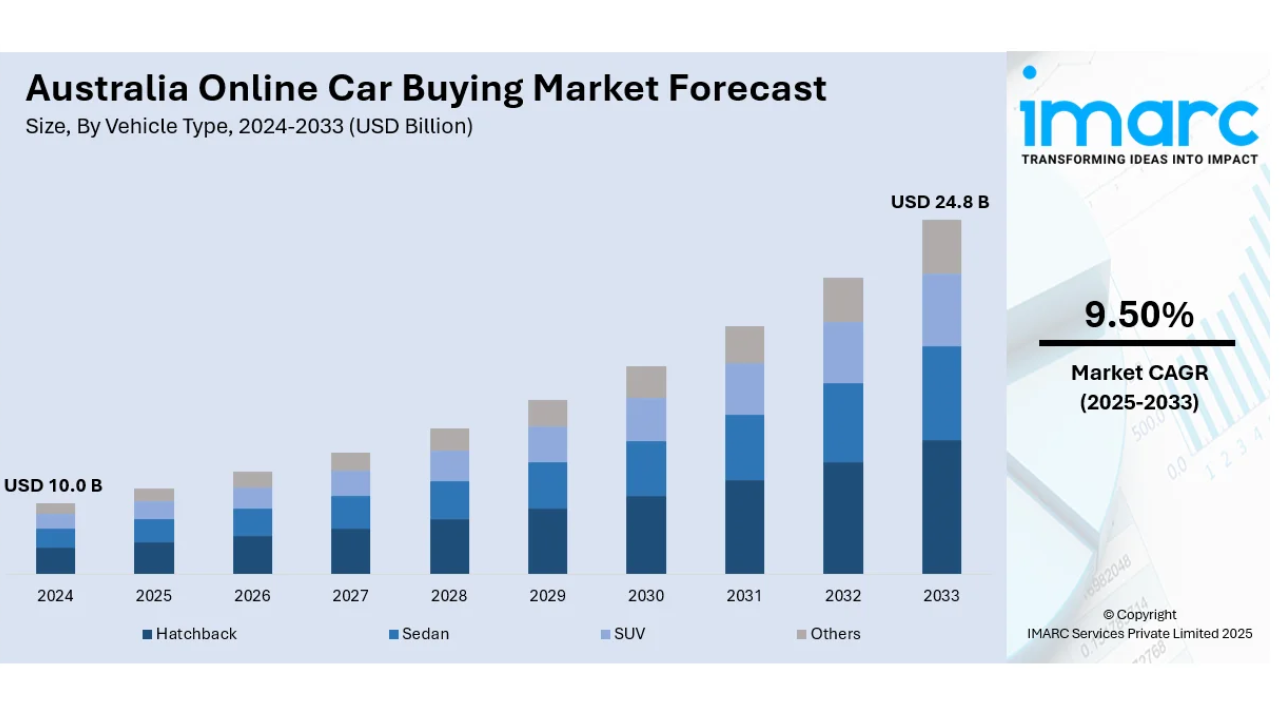

Australia Online Car Buying Market Projected to Reach USD 24.8 Billion by 2033

By Ranjeet Sharma 29-10-2025 36

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 10.0 Billion

Market Forecast in 2033: USD 24.8 Billion

Market Growth Rate (2025-2033): 9.50%

Australia Online Car Buying Market Overview

The Australia online car buying market is experiencing robust growth fueled by accelerating digital adoption across demographics, rising consumer demand for convenience and time efficiency, contactless payment preferences post-pandemic, and comprehensive digital platforms offering seamless purchasing experiences. The market transformation is driven by virtual showrooms with immersive 3D environments, convenient price comparison tools enabling informed decision-making, integrated digital financing and insurance options, and improved consumer confidence in secure online transaction channels. Buyers increasingly value the ability to browse, compare, and purchase vehicles without visiting multiple dealerships, supported by technological advancements including 360-degree car views, AI-powered recommendation engines, and virtual test drive capabilities that replicate physical showroom experiences from home comfort.

Australia's online car buying industry demonstrates strong evolution through digital transformation in used vehicle sales platforms, hassle-free purchasing experience delivery, virtual showroom and digital retailing technology adoption, and end-to-end online service integration covering financing, trade-ins, insurance, and home delivery. The market maintains critical importance across new vehicle purchases, pre-owned vehicle transactions, and diverse vehicle type segments including hatchbacks, sedans, SUVs, and specialty vehicles across petrol, diesel, and alternative propulsion categories. The proliferation of mobile-first browsing interfaces, AI-driven personalization algorithms, comprehensive digital documentation processes, and subscription-based vehicle models is creating favorable market conditions, requiring substantial investments in digital infrastructure enhancement, logistics and delivery optimization, trust-building transparency measures, and regional accessibility expansion. Australia's strategic focus on addressing urban-rural accessibility gaps, combined with growing digital literacy and internet penetration nationwide, makes it an increasingly dynamic market for online automotive retail innovation and customer-centric digital commerce transformation.

Request For Sample Report:

https://www.imarcgroup.com/australia-online-car-buying-market/requestsample

Australia Online Car Buying Market Trends

• Digital transformation in used vehicle sales: Tremendous growth fueled by technology improvements in digital platforms with reimagined used vehicle websites enhancing customer experience, increasing conversion rates by 25%, reducing bounce rates by 35%, and boosting site engagement time by 70% through optimized user interfaces.

• Rising demand for hassle-free car buying: Expanding consumer preference for browsing, comparing, and purchasing vehicles online without dealership visits driven by time efficiency desires, wide model exploration capabilities, price checking convenience, and comprehensive review access from home comfort.

• Virtual showrooms and digital retailing: Emergence of immersive 3D environments, virtual tour capabilities, and online vehicle configurators enabling customization from home, reducing dealership visit necessity, simplifying decision-making processes, and attracting tech-savvy consumers prioritizing transparency and digital independence.

• Contactless transactions reshaping preferences: Post-pandemic behavioral shifts prioritizing safety, convenience, and minimal physical interaction driving adoption of digital documentation, virtual vehicle tours, home test drives, and complete purchase management from selection to delivery without dealership visits.

• End-to-end online services enhancement: Comprehensive digital solutions advancing beyond basic listings to include immediate financing approvals, trade-in assessments, insurance options, warranty offerings, and home delivery creating streamlined experiences with increased transparency and reduced paperwork.

• AI and data-driven personalization: Artificial intelligence and analytics examining browsing habits, preferences, budget ranges, and location details to suggest appropriate vehicles, recommend financing choices, offer time-sensitive deals, and provide follow-up reminders enhancing relevance, engagement, and conversion rates.

Market Drivers

• Digital literacy and internet penetration: Growing digital proficiency with significant population comfortable using platforms for major transactions, expanding trust in high-value online purchases, and dependable internet access across urban and regional locations enhancing online platform reach and user confidence.

• COVID-19 pandemic acceleration: Safety concerns and restrictions pushing buyers toward digital solutions with lasting convenience preferences for online car buying remaining attractive post-pandemic, permanently altering consumer behavior patterns favoring contactless purchasing experiences.

• Technological advancement integration: Implementation of virtual showrooms, 360-degree vehicle views, AI-powered recommendations, digital financing tools, online vehicle inspections, and secure payment methods increasing consumer confidence in purchases without physical dealership interactions.

• Convenience and time efficiency demand: Consumer desire for streamlined purchasing processes enabling exploration of wide model ranges, price comparisons, and review reading from home, eliminating need for multiple dealership visits and lengthy in-person negotiation sessions.

• Comprehensive service bundling: Availability of integrated financing options, trade-in evaluations, insurance quotes, warranty packages, and home delivery services within single platforms removing necessity for multiple third-party interactions and simplifying purchase completion.

• Regional and remote accessibility: Online platforms addressing mobility needs of buyers in regional and remote locations with limited conventional dealership access through larger vehicle selections, remote test drive options, home delivery capabilities, and digital consultation tools.

Challenges and Opportunities

Challenges:

- Lack of physical inspection with many buyers remaining reluctant to finalize purchases without test driving, examining interiors, or assessing vehicle condition in person, particularly for used vehicles where physical wear evaluation remains difficult despite 360° videos and inspection reports

- Trust and transparency concerns regarding accuracy of vehicle descriptions, hidden fees, service history verification, and overall platform credibility deterring high-value online transactions without adequate reassurance through transparent pricing, third-party inspections, and verified listings

- Logistics and delivery complexities involving vehicle transport coordination across long distances, secure handling requirements, real-time tracking capabilities, and clear delivery timeline communication affecting customer satisfaction and operational efficiency

- Limited digital comfort among traditional buyers with segments of population preferring conventional dealership experiences, personal sales interactions, and physical vehicle evaluation creating adoption barriers for fully online purchasing models

- Post-sale service uncertainties including warranty support accessibility, dispute resolution mechanisms, and maintenance service coordination creating hesitation among buyers concerned about ongoing vehicle ownership support through digital channels

Opportunities:

- Expansion into regional and remote areas catering to consumers beyond major urban centers through larger online vehicle selections, remote test drives, home delivery services, digital consultation tools, and 360° vehicle views narrowing urban-rural accessibility gaps

- Integration of financing and insurance creating cohesive purchasing experiences with instant loan calculators, pre-approvals, EMI plans, on-platform insurance quotes providing transparency, control, and consolidated convenience attracting first-time buyers and busy professionals

- AI-powered personalization utilizing browsing habit analysis, preference tracking, budget assessment, and location data to suggest relevant vehicles, recommend financing options, and deliver time-sensitive deals increasing engagement and conversion rates

- Hybrid model development combining online convenience with optional in-person appointments, return policies, home test drives, and dealership pickup options addressing physical inspection concerns while maintaining digital purchasing efficiency benefits

- Enhanced transparency initiatives implementing verified listings, third-party inspection certifications, comprehensive documentation, secure payment systems, visible customer reviews, and reliable support services building trust and consumer confidence in online channels

Australia Online Car Buying Market Segmentation

By Vehicle Type:

- Hatchback

- Sedan

- SUV

- Others

By Propulsion Type:

- Petrol

- Diesel

- Others

By Category:

- Pre-Owned Vehicle

- New Vehicle

By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-online-car-buying-market

Australia Online Car Buying Market News (2023-2024)

• March 2023: Toyota Australia launched revamped used vehicle website powered by Sitecore XM Headless platform achieving remarkable 25% increase in conversion rates, 35% reduction in bounce rates, and 70% boost in time spent on site demonstrating digital transformation impact on consumer behavior.

• 2024: Online car-buying platforms expanded end-to-end digital services integration including immediate financing approvals, trade-in assessments, insurance options, warranty offerings, and home delivery capabilities streamlining purchase processes and reducing third-party interaction requirements.

• 2024: AI-powered recommendation engines and data analytics adoption accelerated across platforms examining browsing habits, preferences, and budget ranges to deliver personalized vehicle suggestions, financing choices, and time-sensitive deals increasing engagement and conversion rates.

• 2024: Virtual showroom technology deployment increased with immersive 3D environments, 360-degree vehicle tours, online configurators, and augmented reality experiences enabling consumers to explore and customize vehicles from home without dealership visits.

• 2024: Contactless transaction services expanded including digital documentation, virtual vehicle inspections, home test drive arrangements, and complete purchase management from selection to delivery responding to post-pandemic consumer preference shifts toward minimal physical interaction.

Key Highlights of the Report

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- Industry Catalysts and Challenges

- Segment-wise historical and future forecasts

- Competitive Landscape and Key Player Analysis

- Vehicle Type, Propulsion Type, Category, and Regional Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=32097&flag=F

Q&A Section

Q1: What drives growth in the Australia online car buying market?

A1: Market growth is driven by digital literacy and internet penetration enabling confident online transactions, COVID-19 pandemic acceleration creating lasting preference shifts, technological advancement integration with virtual showrooms and AI recommendations, convenience and time efficiency demand eliminating dealership visits, comprehensive service bundling within single platforms, and regional accessibility expansion addressing remote location mobility needs.

Q2: What are the latest trends in this market?

A2: Key trends include digital transformation in used vehicle sales with optimized platforms increasing conversion rates, rising demand for hassle-free purchasing experiences without dealership visits, virtual showrooms and digital retailing with immersive 3D environments, contactless transactions reshaping post-pandemic buyer preferences, end-to-end online services from financing to delivery, and AI-driven personalization enhancing engagement through targeted recommendations.

Q3: What challenges do companies face?

A3: Major challenges include lack of physical inspection creating reluctance for online-only purchases particularly for used vehicles, trust and transparency concerns regarding vehicle descriptions and hidden fees deterring high-value transactions, logistics and delivery complexities affecting satisfaction across long-distance transport, limited digital comfort among traditional buyer segments, and post-sale service uncertainties including warranty support accessibility.

Q4: What opportunities are emerging?

A4: Emerging opportunities include expansion into regional and remote areas with home delivery and digital consultation tools, integration of financing and insurance creating consolidated convenience, AI-powered personalization delivering relevant recommendations and increasing conversions, hybrid model development combining online convenience with optional in-person appointments, and enhanced transparency initiatives building consumer trust through verified listings and third-party inspections.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302