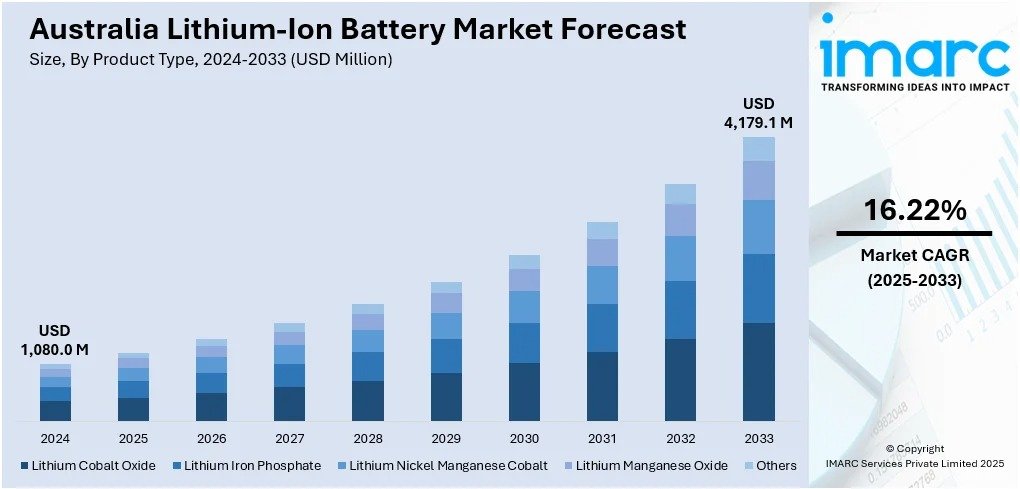

Australia Lithium-Ion Battery Market Projected to Reach USD 4.18 Billion by 2033

By Ranjeet Sharma 29-09-2025 36

Base Year: 2024

Forecast Years: 2025–2033

Historical Years: 2019–2024

Market Size in 2024: USD 1,080.0 Million

Market Forecast in 2033: USD 4,179.1 Million

Market Growth Rate (2025–2033): 16.22%

Australia Lithium-Ion Battery Market Overview

The Australia lithium-ion battery market is undergoing rapid expansion since consumer tastes shift toward small mobile tools needing effective storage with power backups, minerals abound featuring lithium ores at sites such as Greenbushes plus Finniss, renewables merge needing large-scale grids, policies help through National Battery Strategy plus Critical Minerals Strategy, and ESG forces foster green mining with material reuse. Major projects such as Victorian Big Battery and South Australia installations stabilize state grids, downstream value capture initiatives promote local processing and component manufacturing, along with Western Australia's Future Battery Industry Strategy provides incentives and infrastructure support, and these support the market's expansion. Australia's lithium-ion battery market, positioned toward transformative growth and value chain development, sees improved focus on safer battery chemistries like LFP, innovation in battery management systems, and remote mining electrification opportunities.

Australia does have a lithium-ion battery foundation that shows extraordinary resource endowment. Western Australia has the world's largest lithium deposits providing high-grade spodumene along with battery feedstocks. The country keeps to a more calculated position in the global battery supply chain. The government commits itself to the work of developing domestic processing refining and also component manufacturing capabilities that exist beyond just raw mineral exports. Renewable energy projects proliferate, grid-scale storage systems exist, and residential solar-battery combinations materialize, thus market conditions become favorable since substantial investments refine facilities, assemble cell plants, and recycle infrastructure. Australia has in it a unique combination of an abundant amount of critical minerals, a strong form of governance framework, a renewable energy transition toward momentum, and government policy in alignment that makes for it an increasingly attractive market for integrated battery value chain in development and technological innovation, and this positions the nation as a major global battery as a supplier.

Request For Sample Report:

https://www.imarcgroup.com/australia-lithium-ion-battery-market/requestsample

Australia Lithium-Ion Battery Market Trends

• Renewable energy storage expansion: Increasing grid-scale installations including Victorian Big Battery and South Australia projects stabilizing electricity supply through frequency control and peak demand management supporting renewable integration.

• Value chain localization: National Battery Strategy promoting domestic processing from raw lithium to refined materials, cathode/anode production, and cell assembly capturing downstream economic value beyond mineral exports.

• Chemistry innovation focus: Growing adoption of Lithium Iron Phosphate (LFP) for safety, stability, and cost benefits with stricter regulations on battery imports addressing thermal runaway incidents particularly in e-mobility products.

• Residential solar-battery adoption: Strong uptake of rooftop solar combined with home battery systems leveraging Australia's abundant sunshine creating demand for lower-scale residential storage solutions.

• Remote mining electrification: Hybrid systems integrating solar-wind-battery replacing diesel generation at remote operations reducing fuel costs and emissions while meeting ESG objectives and investor requirements.

• Recycling infrastructure development: Government regulations implementing end-of-life battery management, collection systems, and recycling facilities addressing environmental concerns and material recovery opportunities.

Market Drivers

• Rich mineral resource base: World-leading lithium deposits at Greenbushes, Finniss, and other operations providing high-grade spodumene feedstocks creating competitive advantage in raw material supply supporting domestic value chain development.

• Renewable energy transition: Rapid deployment of utility-scale solar and wind farms requiring robust battery storage for grid stabilization, frequency control, and excess energy management supporting fossil fuel displacement.

• Government policy support: National Battery Strategy, Critical Minerals Strategy, and state-level incentives providing grants, tax relief, expedited approvals reducing capital barriers for processing, manufacturing, and R&D investments.

• Grid modernization requirements: Aging transmission infrastructure and increasing renewable penetration creating demand for battery systems enabling load balancing, peak demand management, and network upgrade deferral.

• ESG and sustainability pressure: International customer requirements from automakers and energy utilities compelling responsible sourcing, greener mining practices, and enhanced end-of-life battery recycling and circular economy implementation.

• Innovation ecosystem development: Government funding for research into advanced chemistries, silicon anodes, and next-generation materials with pilot plants and demonstration facilities converting academic research into commercial products.

Challenges and Opportunities

Challenges:

- Raw material price volatility with global demand fluctuations affecting lithium, nickel, and cobalt prices eroding mining and refining economics particularly during EV sales slowdowns or policy shifts

- Supply chain dependence on overseas processing capacities primarily in Asia creating vulnerability to trade barriers, transport cost increases, and shifts in international demand affecting Australian operations

- Energy and infrastructure constraints with remote locations requiring expensive power, water, and logistics infrastructure increasing operational costs and carbon footprints compared to lower-cost jurisdictions

- Market competition from countries offering cheaper labor, energy costs, and government subsidies attracting battery component manufacturing and cell assembly investments creating rivalry for capital and talent

- Technology evolution risks with emerging chemistries, cell formats, and alternative storage technologies potentially disrupting demand for specific lithium-ion configurations requiring flexible investment strategies

Opportunities:

- Grid-scale storage expansion supporting renewable energy transition through utility partnerships, independent power producer investments, and government contracts for frequency regulation and peak demand management services

- Off-grid mining electrification providing hybrid solar-wind-battery systems to remote operations reducing diesel dependence, cutting fuel costs, and meeting corporate sustainability targets and ESG commitments

- Domestic value-chain development establishing refining, component manufacturing, and cell assembly capabilities creating jobs, capturing economic value, and reducing import dependence while positioning for regional exports

- Asia-Pacific export potential supplying battery components, refined materials, or finished systems to neighboring markets seeking reliable high-quality supply from politically stable jurisdiction with strong governance

- Innovation commercialization advancing pilot plants for next-generation cathode materials, hybrid chemistries (LFP, LMFP), and enhanced battery management systems differentiating Australian technology offerings in competitive global market

Australia Lithium-Ion Battery Market Segmentation

By Product Type:

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

By Power Capacity:

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

By Application:

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Lithium-Ion Battery Market News (2024–2025)

• 2024: National Battery Strategy implementation advanced promoting domestic value chain development from raw lithium processing to component manufacturing and cell assembly supported by federal funding and regulatory frameworks.

• 2024: Western Australia Future Battery Industry Strategy provided state-level incentives including fee waivers, low-interest loans, and infrastructure access promoting downstream processing and value-adding manufacturing within the state.

• 2024: Major grid-scale battery projects expanded including Victorian Big Battery and New South Wales installations providing frequency control, peak demand management, and renewable energy integration supporting state electricity grids.

• 2024: Remote mining operations accelerated adoption of hybrid solar-wind-battery systems replacing diesel generation reducing fuel costs and emissions while meeting ESG objectives and attracting sustainable investment capital.

• 2024: Regulatory tightening on battery imports and safety standards implemented following e-bike and scooter fire incidents promoting safer chemistries, better battery management systems, and stricter certification requirements.

Key Highlights of the Report

- Market Performance (2019–2024)

- Market Outlook (2025–2033)

- Industry Catalysts and Challenges

- Segment-wise historical and future forecasts

- Competitive Landscape and Key Player Analysis

- Product Type, Power Capacity, and Application Analysis

Q&A Section

Q1: What drives growth in the Australia lithium-ion battery market?

A1: Market growth is driven by rich mineral resource base with world-leading lithium deposits providing competitive raw material advantage, renewable energy transition requiring grid-scale storage for solar and wind integration, government policy support through National Battery Strategy and Critical Minerals Strategy providing incentives, grid modernization requirements for load balancing and network management, ESG and sustainability pressure from international customers, and innovation ecosystem development through government-funded research and pilot facilities.

Q2: What are the latest trends in this market?

A2: Key trends include renewable energy storage expansion with major grid-scale projects in Victoria and South Australia, value chain localization capturing downstream economic value beyond mineral exports, chemistry innovation focus on safer LFP alternatives with stricter regulations, residential solar-battery adoption leveraging abundant sunshine, remote mining electrification replacing diesel with hybrid systems, and recycling infrastructure development addressing end-of-life battery management and material recovery.

Q3: What challenges do companies face?

A3: Major challenges include raw material price volatility with global demand fluctuations affecting economics, supply chain dependence on overseas processing creating vulnerability to trade disruptions, energy and infrastructure constraints in remote locations increasing operational costs, market competition from countries offering cheaper inputs and subsidies, and technology evolution risks with emerging alternatives potentially disrupting specific lithium-ion configurations.

Q4: What opportunities are emerging?

A4: Emerging opportunities include grid-scale storage expansion supporting utility renewable integration and frequency regulation services, off-grid mining electrification providing hybrid systems reducing diesel dependence and emissions, domestic value-chain development establishing refining and manufacturing capturing economic value, Asia-Pacific export potential supplying reliable components from stable jurisdiction, and innovation commercialization advancing next-generation cathode materials and battery management systems.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.